As a contractor, it is crucial to maintain proper documentation of your transactions to ensure transparency and build trust with your clients. One essential document that serves as proof of payment is the contractor’s receipt.

This article will explore what a contractor receipt is, its main purpose, the benefits of providing one, the information it should contain, and how to create a contractor receipt.

What is a Contractor Receipt?

A contractor receipt is a document that contractors provide to their clients after receiving payment for their services. It serves as a written confirmation of the transaction, showing that the client has fulfilled their financial obligation and the contractor has received the payment.

This receipt not only provides clarity but also serves as legal evidence of the transaction.

What Is The Main Purpose Of A Receipt?

The main purpose of a contractor receipt is to provide clarity and proof of payment for both the client and the contractor. It serves as a formal acknowledgment of the financial transaction and ensures that both parties are aware of the payment made.

Additionally, a receipt can be used for various purposes, including:

- Tax purposes: Contractors can use receipts to track their income and expenses for tax reporting.

- Dispute resolution: In case of any disagreement or dispute regarding payment, the receipt can serve as evidence of the agreed-upon amount.

- Insurance claims: If the contractor is covered by insurance, the receipt can be used as documentation for potential claims.

What Are The Benefits Of Providing A Contractor Receipt?

Providing a receipt offers several benefits for both contractors and clients:

- Clarity: A receipt provides clear information about the payment, including the date, amount, and method of payment, ensuring both parties are on the same page.

- Professionalism: Offering a receipt demonstrates professionalism and attention to detail, enhancing the contractor’s reputation and building trust with clients.

- Record-keeping: Receipts help contractors maintain organized financial records, making it easier to track income, and expenses, and reconcile accounts.

- Tax compliance: Receipts are essential for accurate tax reporting, ensuring contractors can claim legitimate deductions and avoid potential audit issues.

- Dispute resolution: In case of any payment disputes or misunderstandings, a receipt can serve as evidence of the agreed-upon terms, facilitating resolution.

What Information Is On A Contractor Receipt?

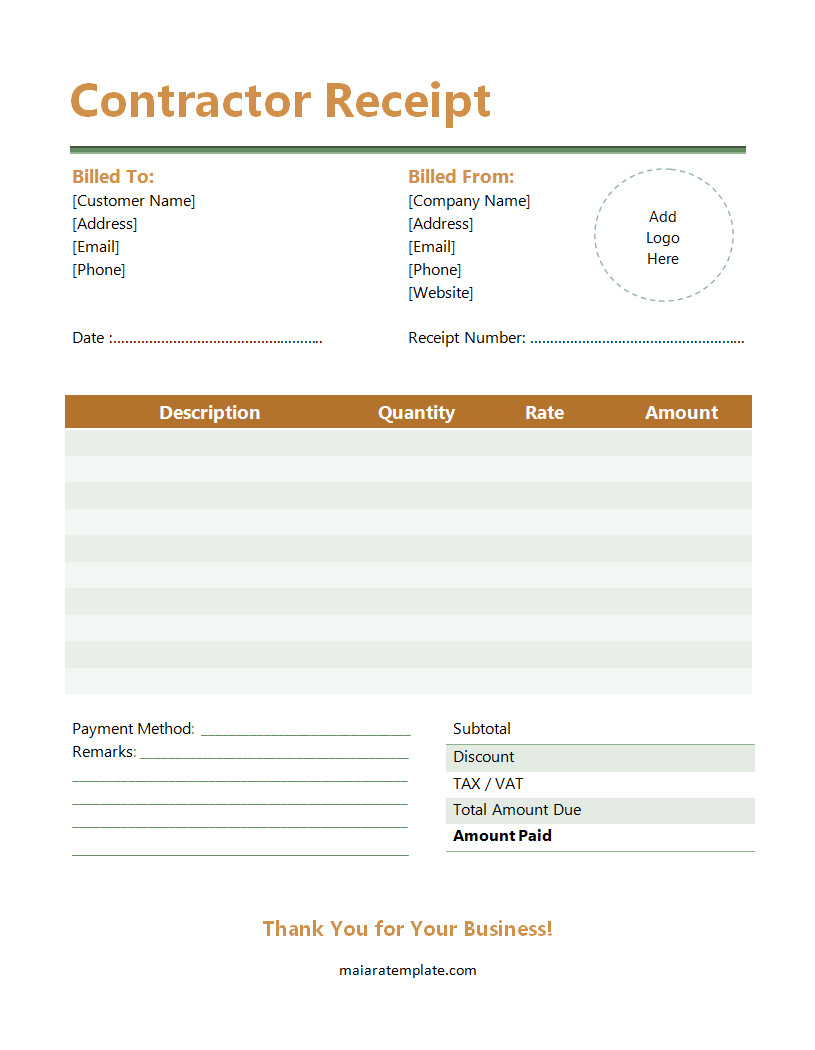

A well-crafted receipt should include the following information:

- Contractor’s information: Include your name or company name, address, contact details, and any relevant identification numbers (e.g., tax ID).

- Client’s information: Provide the client’s name, address, and contact details.

- Description of services: Clearly state the services provided, including the scope of work, materials used (if applicable), and any specific details that help identify the transaction.

- Date of payment: Specify the date on which the payment was made.

- Payment details: Include the amount paid, the method of payment (cash, check, credit card, etc.), and any relevant payment reference numbers.

- Terms and conditions: If applicable, include any terms and conditions related to the payment, such as payment due dates or late payment penalties.

- Signature: Both the contractor and the client should sign the receipt to acknowledge the transaction.

It is crucial to ensure that the receipt is legible and well-organized, making it easy for both parties to understand the details of the transaction.

How Do I Make A Contractor Receipt?

Creating a receipt is relatively simple, and there are multiple options available:

- Using templates: Download and use our free customizable contractor receipt template in Word format available on this website.

- Designing your own: If you prefer a personalized receipt, you can design one using word-processing software or spreadsheet programs. Start with a blank document and include all the required information.

- Using accounting software: If you use accounting software for your business, it likely has built-in receipt templates or features that allow you to generate professional receipts easily.

Regardless of the method you choose, ensure that the receipt is clear, well-organized, and includes all the essential information mentioned earlier. It is also a good practice to keep copies of all receipts for your records and provide a copy to the client.

Free Contractor Receipt Template!

A contractor receipt is a crucial document that provides clarity and proof of payment for both contractors and clients. By offering a detailed receipt, contractors demonstrate professionalism, maintain accurate records, and ensure compliance with tax regulations. Clients benefit from the transparency and legal protection that receipts provide.

Therefore, contractors need to prioritize the creation and provision of contractor receipts for every transaction.

Use our contractor receipt template in Word format to simplify your payment process and provide clients with professional, detailed receipts.

Contractor Receipt Template – Word

- Customizable Restaurant Menu Template (Word) - December 22, 2024

- Customizable Sushi Menu Template (Word) - December 19, 2024

- Free Editable Job Description Template (Word) - December 15, 2024