Managing personal finances can be a daunting task, especially when it comes to keeping track of income and expenses. With the help of a semi-monthly budget, individuals can gain better control over their finances and make informed decisions about their spending habits. This financial tool provides a clear and organized way to monitor income, track expenses, and allocate funds effectively.

This article will explore a semi-monthly budget, why it is beneficial, how to create one, and some smart budgeting tips for first-time savers.

What is a Semi-Monthly Budget?

A semi-monthly budget is a financial tool that allows individuals to track their income and expenses over two weeks. Unlike a monthly budget covering an entire month, a semi-monthly budget focuses on a shorter time frame. This can be particularly useful for those who receive paychecks twice a month or have irregular income streams.

A semi-monthly budget helps individuals gain a better understanding of their cash flow by providing a detailed breakdown of income and expenses. By tracking their spending habits, individuals can identify areas where they may be overspending or where they can potentially save money. This budgeting method allows for greater flexibility and adaptability, as it takes into account the specific needs and circumstances of the individual.

Why Use a Semi-Monthly Budget?

Using a semi-monthly budget can bring numerous benefits to individuals looking to manage their finances effectively.

Here are some reasons why you should consider using a semi-monthly budget:

- Improved awareness of spending habits. A semi-monthly budget provides a clear overview of your income and expenses, allowing you to see exactly where your money is going. This heightened awareness can help you make more informed decisions about your spending and identify areas where you can cut back.

- Ability to plan. By tracking your income and expenses over two weeks, you can plan more effectively. This can be particularly useful for individuals with irregular income or those who need to allocate funds for upcoming expenses.

- Better control over finances. With a semi-monthly budget, you have a clearer understanding of your financial situation. This knowledge empowers you to take control of your finances and make proactive decisions to achieve your financial goals.

- Flexibility and adaptability. Unlike a monthly budget, a semi-monthly budget allows for greater flexibility. It takes into account the specific needs and circumstances of the individual, making it easier to adjust and adapt the budget as necessary.

How to Create a Semi-Monthly Budget

Creating a semi-monthly budget is a straightforward process that can be done in a few simple steps. Here is a step-by-step guide to help you create your own:

- Gather your financial information. Start by collecting all your financial information, such as pay stubs, bank statements, and bills. This will give you a clear picture of your income and expenses.

- List your income. Make a list of all your sources of income for the two weeks. This may include your salary, freelance work, or any other income streams you have.

- Track your expenses. Keep track of all your expenses during the two weeks. Categorize them into different categories, such as housing, transportation, groceries, entertainment, and savings.

- Calculate your net income. Subtract your total expenses from your total income to calculate your net income. This will give you an idea of how much money you have left after paying for your expenses.

- Review and adjust. Take a close look at your budget and identify areas where you can make adjustments. Look for opportunities to save money and cut back on unnecessary expenses.

- Stick to your budget. Once you have created your semi-monthly budget, it is important to stick to it. Monitor your spending and make adjustments as needed to ensure that you are staying on track.

Smart Budgeting Tips for First-Time Savers

For individuals who are new to budgeting, getting started can feel overwhelming. Here are some smart budgeting tips to help first-time savers:

- Set realistic goals. Start by setting realistic financial goals that are achievable. Whether it’s saving for a vacation or paying off debt, having specific goals can provide motivation and direction.

- Create an emergency fund. Building an emergency fund is essential for financial security. Aim to save at least three to six months’ worth of living expenses to protect yourself from unexpected financial hardships.

- Track your spending. Keep a record of all your expenses to gain a better understanding of where your money is going. This will help you identify areas where you can cut back and save.

- Use budgeting apps or tools. Take advantage of budgeting apps or tools that can automate the budgeting process and make it easier to track your income and expenses.

- Review and adjust regularly. Budgeting is an ongoing process, so it’s important to review and adjust your budget regularly. As your financial situation changes, make necessary adjustments to ensure that your budget remains effective.

By following these smart budgeting tips and using a semi-monthly budget, you can take control of your finances and work towards achieving your financial goals. Remember, budgeting is a skill that improves over time, so be patient with yourself and stay committed to your financial journey.

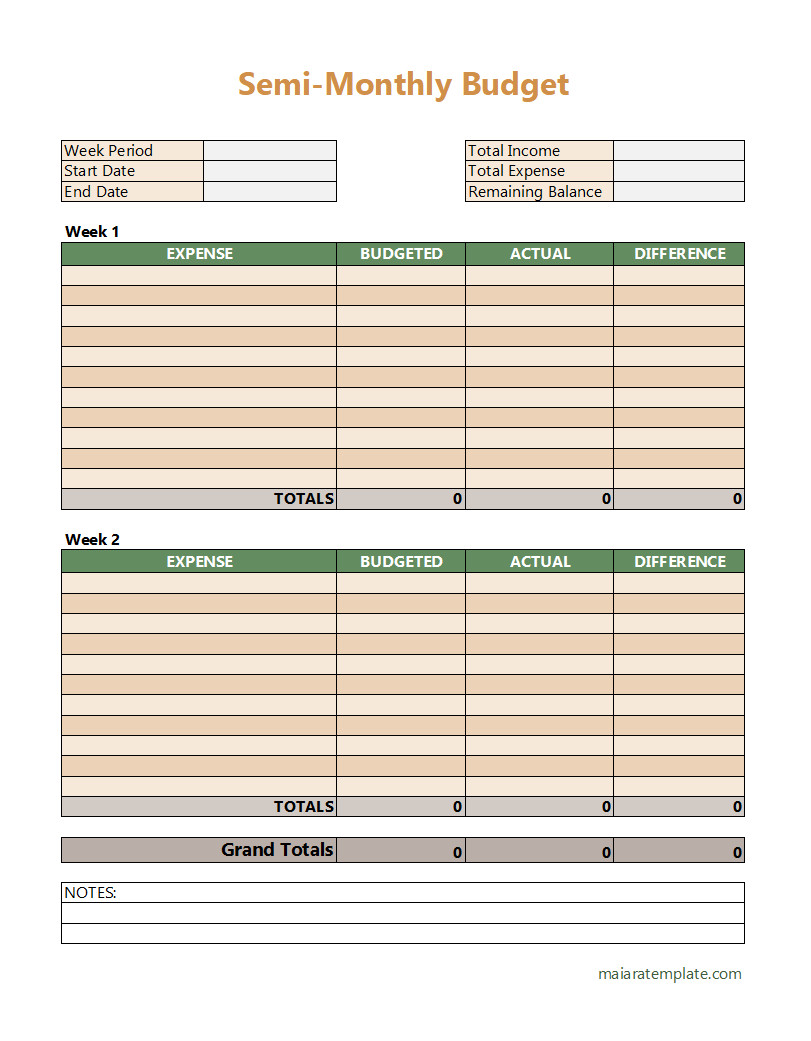

Free Semi-monthly Budget Template!

Manage your finances with ease using our semi-monthly budget template! Designed for those paid twice a month, this template helps you track income, expenses, and savings in a clear, organized way.

Stay on top of bills, plan for essentials, and achieve your financial goals with confidence. Perfect for maintaining balance and avoiding surprises, our template makes budgeting simple and effective for every pay period!

Semi-monthly Budget Template – Excel | PDF

- Customizable Restaurant Menu Template (Word) - December 22, 2024

- Customizable Sushi Menu Template (Word) - December 19, 2024

- Free Editable Job Description Template (Word) - December 15, 2024